Apply for a Reprise Financial Loan & Get Funds by the Next Business Day

Do you need a loan but don’t know where to start? Loans help people pay for big things, but picking the right one is important.

Reprise Financial has different loan options for different needs. You might need money to pay off debt, cover an emergency, or buy something big.

However, some loans have high interest or tricky rules, which can make borrowing hard. A good loan should have clear rules, fair rates, and easy payments.

Knowing how loans work can keep you from money problems. If you make smart choices, a loan can help instead of hurt. Let’s know more about this loan and how it can be helpful.

How Reprisal Financial Loans Work?

Applying for a loan is quick and easy. You can fill out an online application in just a few minutes. After applying, you’ll know if you’re pre-approved based on your credit and financial situation.

Once you apply, you’ll see loan offers right away. These offers show you the loan amount, interest rate, and how much your monthly payment will be. You can borrow anywhere from $2,500 to $25,000 depending on your needs.

Reprise Financial doesn’t charge any penalties if you pay off your loan early. You can pay it off as fast as you want without worrying about extra fees.

The loan rates stay the same throughout the loan period, so you’ll always know how much you need to pay each month. The loan months can be from 36 to 60 months and the interest rate ranges from 9.99% to 35.99 %.

After you get approved, you can receive your loan money as soon as the next business day. This helps if you need money fast for things like emergencies or big purchases.

Reprise makes it easy to manage your loan with an online account. You can check your balance, make payments, and stay updated with your loan anytime you need. If you’re a VCA employee looking for step-by-step Workday or Dayforce login guidance, head over to the VCA Employee Portal on WoofApps.net — your go-to resource for accessing all your internal tools.”

If you have great credit or are still building it, Reprise has loan options for many different credit types. You can choose between unsecured loans or loans that are secured by your car.

Not only this, Reprise has helpful customer service. If you have any questions or need help, you can talk to a real person who will guide you through the process.

Unsecured loan

An unsecured loan does not need any valuable items, like a car or house, to get approved. Instead, the lender looks at the borrower’s credit history to decide if they qualify.

These loans can be helpful for people who have good credit but do not own big assets. Because there is no item to take if the borrower stops paying, lenders charge higher interest rates, especially for those with low credit score loans.

The good part is that borrowers do not risk losing their belongings. These loans are often used for things like paying off debt or handling emergencies.

Lenders check income, credit score, and financial history before approving the loan. While they can be easier to get for those with good credit, they may be expensive for others.

Secured loan

A secured loan requires a valuable item, like a car, to be used as a promise to pay back the money. This promise is called “collateral.”

At Reprise Financial, borrowers can use their car to get a loan. Because the lender has something to take if payments stop, the loan usually has lower interest rates.

People with lower credit scores might find it easier to get approved for this type of loan., if the borrower does not pay, the lender can take the car. To get a secured loan, borrowers must show proof that they own and insure the car.

These loans can be managed online, but phone payments come with a small fee. Secured loans can be a good choice for those who want better rates and higher loan amounts.

Eligibility Requirements for a Reprise Financial Loan

To qualify for a loan through Reprise Financial, there are some important rules you need to follow to make sure you can get the loan you want.

If you need a debt consolidation loan to make your payments easier or are looking for a loan to consolidate debt, you must meet the lender’s rules.

Also, knowing about debt consolidation loan rates can help you pick the best loan for you.

☑️ Be a U.S. citizen or resident with an address in the United States

☑️ You must have proof of identification, like a driver’s license, state ID, or passport.

☑️ Loan amounts range from $2,500 to $25,000, depending on eligibility.

☑️ You must be at least 18 years old to qualify for a loan.

☑️ No more than two Reprise loans in the past 12 months.

☑️ Have a steady job or other income (self-employment not counted as main income).

☑️ Credit and banking history will be reviewed.

☑️ Secured loans require a vehicle under 20 years old.

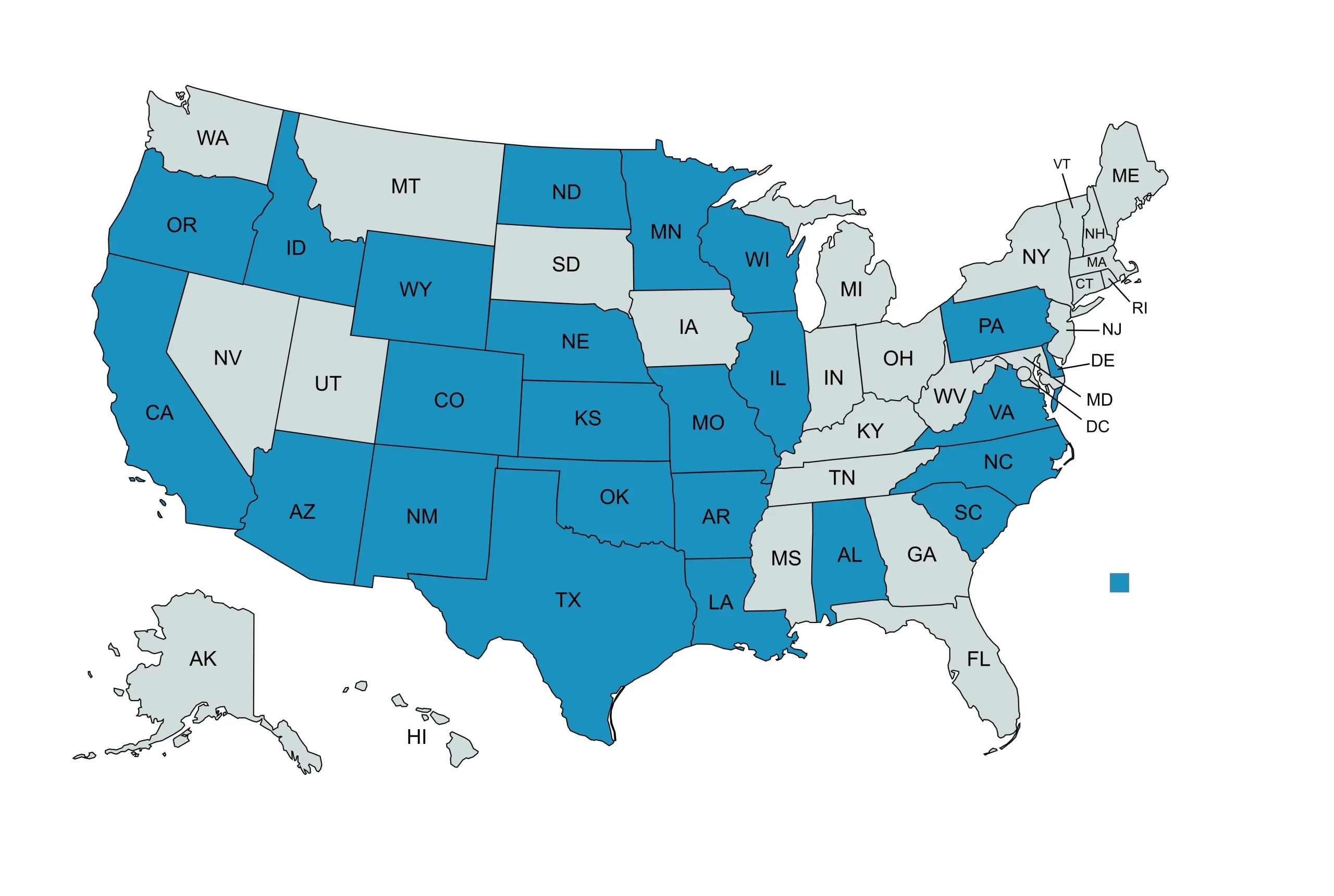

States With Reprise Financial Loans

Reprise Financial personal loans are available in many states. People who live in these states can apply for loans and get help with their finances. If you live in one of these states, you can use Reprise Financials loan services. Here are the states.

| # | STATE | SYMBOL |

|---|---|---|

| 1 | Alabama | AL |

| 2 | California | CA |

| 3 | Colorado | CO |

| 4 | Delaware | DE |

| 5 | Idaho | ID |

| 6 | Illinois | IL |

| 7 | Kansas | KS |

| 8 | Louisiana | LA |

| 9 | Nebraska | NE |

| 10 | New Mexico | NM |

| 11 | North Carolina | NC |

| 12 | North Dakota | ND |

| 13 | Oklahoma | OK |

| 14 | Oregon | OR |

| 15 | Pennsylvania | PA |

| 16 | Texas | TX |

| 17 | Virginia | VA |

| 18 | Wisconsin | WI |

| 19 | Wyoming | WY |

| 20 | Missouri | MO |

| 21 | Minnesota | MN |

| 22 | Arizona | AZ |

| 23 | Arkansas | AR |

| 24 | South Carolina | SC |

Loans By the Credit

Loans by credit help people borrow money based on their credit score. If you have good credit, it is easier to get a loan with low interest rates.

There are different types of credit loans, like personal loans, home equity loans, and credit cards with no interest. Whether you need dental loans, medical loans, or vacation loans, there are options available to fit your needs.

Online lenders make it simple to apply and get money fast. You can also explore simple loans, emergency car title loans, and engagement ring financing to cover unexpected expenses or special purchases.

Personal Loans for Bad Credit

- Bad credit means a low credit score (580 or less), which makes it harder to get a loan.

- Bad credit personal loans help people with low credit scores who can’t get loans from regular banks.

- Some loans need collateral (like a car), while others don’t.

- Lenders charge higher interest rates because bad credit borrowers are seen as risky.

- Paying back a loan on time can help improve your credit score.

- These loans can help with emergencies or paying off other debts.

Personal Loans for Excellent Credit

- Excellent credit usually means a score of 800 or higher.

- People with excellent credit get lower interest rates and better loan offers.

- Lenders may let you borrow more money because you are low-risk.

- You can use these loans for things like paying off debt, wedding loans, or emergencies.

- Lenders check your income, credit history, and how much debt you already have.

- Making payments on time helps keep your credit score high.

Personal Loans for Fair Credit

- Fair credit means a score between 580 and 669.

- You can still get a loan, but the interest rate may be higher.

- Lenders look at your full application, not just your credit score.

- Online lenders make it easy to apply for and get simple fast loans.

- You may have a better chance if you have a steady income or offer something valuable, like a car, as collateral.

- Make sure you can afford monthly payments before taking a loan.

Personal Loans for Good Credit

- Having a good credit score helps you get a loan with lower interest.

- Lenders look at more than your credit score, like your income and debts.

- You can use personal loans for many things, like home repairs or paying off other debts.

- Online lenders make it easy to apply and can send money fast.

- People with good credit can choose from different loans, like home equity loans or credit cards with no interest.

How may a Reprise Financial loan be used?

Reprise Financial gives personal loans that people can use for many things.

For example, the Reprise Financial website (www.reprise financial.com) shows a picture listing different ways to use the loan, like paying off credit cards, combining debts, covering dental bills, or buying an engagement ring.

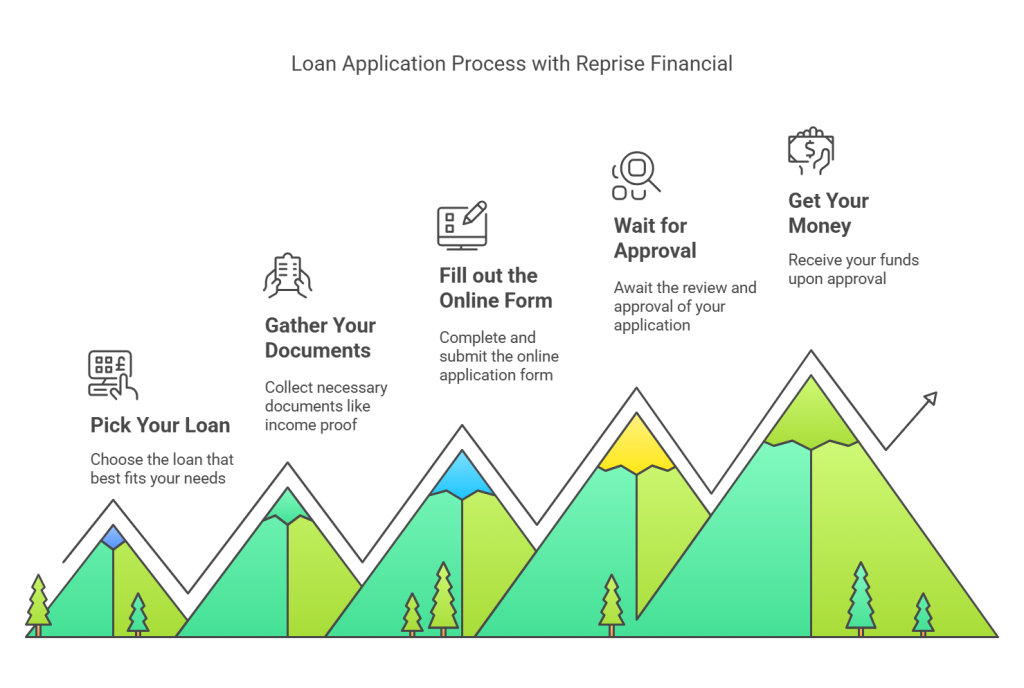

How to Apply for a Loan with Reprise Financial?

1. Pick Your Loan

Choose the loan according to your needs, like paying off the debt or covering any emergency.

2. Gather your documents

Before applying collect your papers likes;

☑️ Proof of income.

☑️ Bank statements.

☑️ Identification.

3. Fill out the Online Form

To the website, complete the form and upload your documents.

4. Wait for Approval

Reprise Financial will check your information and verify your details.

5. Get Your Money

If approved, you could get your money as soon as the next business day.

Loan Terms and Conditions

Before you borrow money from Reprise Financial, it’s important to understand the loan terms. These terms explain how the loan works, what you need to do, and what to expect. By agreeing to these terms, you are entering into a legal agreement with Reprise Financial, so be sure to read everything carefully.

Changes to Services

Reprise Financial may update, change, or stop parts of its services at any time. Sometimes, changes may happen without notice, especially if needed for security or legal reasons. If there are major updates, Reprise Financial will try to inform users through email, website notifications, or other methods. Using the services after a change means agreeing to the new terms.

User Responsibilities

Users must keep their contact details correct and up to date. This includes phone numbers, addresses, and email information. If details are incorrect, users may not receive important messages. Reprise Financial is not responsible for issues caused by wrong or outdated information.

Service Interruptions

Reprise Financial may need to stop services for maintenance or technical problems. While Reprise Financial will try to inform users before planned maintenance, unexpected issues may happen. The company does not guarantee that services will always be available without delays or errors.

Closing Accounts

Reprise Financial has the right to close or limit access to accounts at any time. If an account is closed, it may no longer be visible in online services.

Sharing and Privacy

Reprise Financial collects and shares user data as described in its Privacy Policy. Users should review this policy to understand how their information is handled.

Liability and Limitations

Reprise Financial provides its services “as is” and does not promise that they will always be perfect, fast, or error-free. The company is not responsible for any losses due to service problems, incorrect account details, or technical errors.

Dispute Resolution

Any disputes with Reprise Financial may be settled through arbitration instead of court. Arbitration is a way to solve disagreements with the help of a neutral third party. Users cannot join class-action lawsuits against the company.

Use of Website Content

Everything on the Reprise Financial website, like logos, pictures, and words, belongs to the company. These things are protected by law. No one is allowed to copy, change, share, or use anything from the website without getting written permission from Reprise Financial. If someone uses the content without permission, the company may take legal action. If permission is given, users must keep all copyright and ownership notices in place.

Governing Laws

These rules follow U.S. federal laws and the state laws that apply to Reprise Financial Services. The laws for each account depend on the agreement made when opening the account. If there is a legal problem, it will be handled according to the laws that apply to Reprise Financial. By using the website, users agree to follow all laws and rules.

How to repay a loan from Reprise Financial?

Reprise Financial gives you different ways to pay back your loan. You can choose the one that is easiest for you and works with your money situation. Whether you want to pay online, have money taken out automatically, or pick another way, you can pick the best option for you.

☑️ Online Payments: You can pay your loan easily online, from your computer or phone.

☑️ Automatic Payments (Auto pay): If you choose auto pay, your payments will be taken automatically from your account. But, there is no discount for using this option.

☑️ Phone Payments: You can also pay by phone, but there is a $5.50 fee for this service.

☑️ Check Payments: Another option is to mail in a check to make your payment.

Pros and Cons

Pros:

☑️ Even with a low credit score, you can still apply for a loan.

☑️ Pick between a secured (with collateral) or unsecured (no collateral) loan.

☑️ Get your loan as soon as possible on the next business day for quick needs.

☑️ Many customers are happy with their loan experience.

☑️ Pay off credit cards, medical bills, home repairs, and more.

Cons:

❌ The loan limit is $25,000, and some lenders offer higher loan amounts for bigger needs.

❌ If your income comes from self-employment, you can’t get a loan.

❌ It’s not available in all states. So some people may not be able to apply due to location limits.

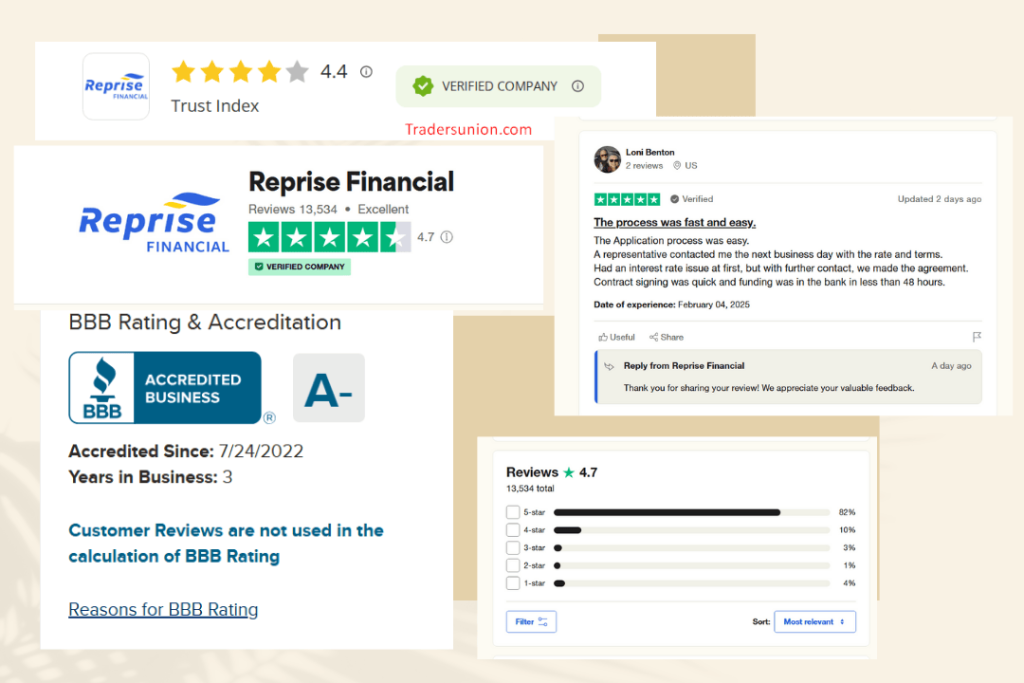

Reprise Financial Reviews Verified Customer Experiences

Reprise Financial helps people with their money needs, and the customers have shared their real experiences. Read honest reviews from people who have used these services. They share about how easy it is to get a loan, how helpful our team is, and how happy they are with it. Check out these reviews to see why so many people trust Reprise Financial.

Reprise Financial Contact

If you have any questions or need help, Reprise Financial is here to help you. Whether you need support with your account, help with an application, with customer service, you can contact them using the information below.

| 📞 Phone | 877-505-6780 |

| Application Support | 7 am – 10 pm CT Monday – Friday |

| 8 am – 6 pm CT Saturday | |

| 9 am – 1 pm CT Sunday | |

| Customer Service | 8 am – 10 pm CT Monday – Friday |

| 8 am – 2 pm CT Saturday | |

| 📬 Mailing Address | P.O. Box 9585, Coppell, TX 75019 |

| Mail Your Payment | P.O. Box 660252, Dallas, TX 75266 |